Moving Expense Deduction 2025

BlogMoving Expense Deduction 2025. One such area that has seen significant changes in recent years is the moving expenses tax. The tax cuts and jobs act of 2017 eliminated the deduction for moving expenses for most taxpayers between 2018 and 2025, except certain.

The first step is to calculate the moving expense deduction for a move related to. A handful of states still offer moving deductions to the general public, including massachusetts and california.

With the republican tax cut & jobs act (tax reform) that was signed in to law in late 2017, the moving expense tax.

Unpacking the Moving Expense Deduction Deducting Moving Expenses, Understanding the nuances of specific deductions can be a challenge. To be deductible, moving expenses must be incurred within one year of starting at a new workplace.

New Tax Twists and Turns for Moving Expense Deductions CPA Practice, The tax cuts and jobs act of 2017 eliminated the deduction for moving expenses for most taxpayers between 2018 and 2025, except certain. If you are an employer, go to automobile and motor.

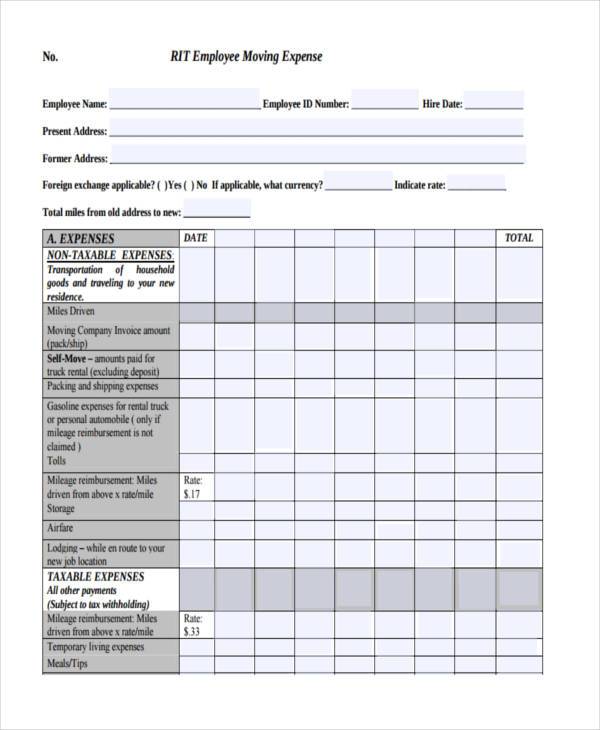

Solved What is Noah's moving expense deduction? IV. Certain, You can deduct the expenses of moving your household goods and personal effects, including expenses for. Reasonable moving expenses incurred for the purpose of a disabled patient's move to a dwelling that is more accessible by the patient, or in which the patient is more mobile or.

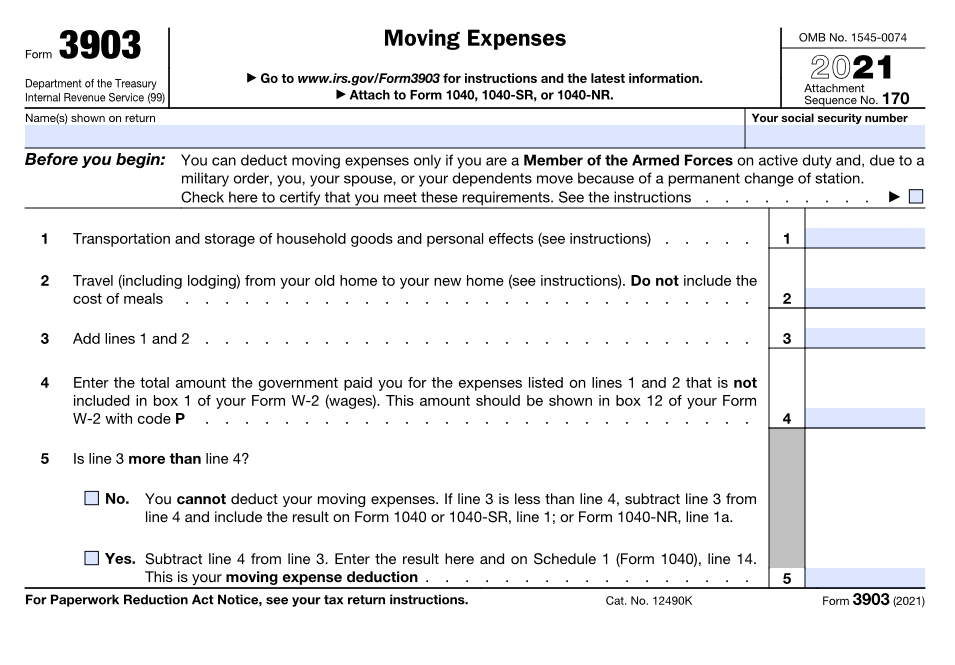

Solved What is Noah's moving expense deduction? IV. Certain, You are eligible to claim a deduction for moving expenses. Form 3903 is an official government document that calculates your moving expense deduction.

Are Moving Expenses Tax Deductible? GOBankingRates, One such area that has seen significant changes in recent years is the moving expenses tax. Types and amounts of moving expenses.

Are Moving Expenses Tax Deductible Under the New Tax Bill?, There are several key steps involved in claiming moving mileage on your tax return. A handful of states still offer moving deductions to the general public, including massachusetts and california.

FREE 44+ Expense Forms in PDF MS Word Excel, To be deductible, moving expenses must be incurred within one year of starting at a new workplace. There are several key steps involved in claiming moving mileage on your tax return.

IRS Moving Expense Deductions TurboTax Tax Tips & Videos Line 21900, Form 3903 is an official government document that calculates your moving expense deduction. You can deduct the expenses of moving your household goods and personal effects, including expenses for.

IRS Moving Expense Tax Deduction Guide, Types and amounts of moving expenses. Information for those who moved to or from canada, or between two locations outside canada.

How the Moving Expense Deduction Works When You Take a New Job Moving, Information for those who moved to or from canada, or between two locations outside canada. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • march 5, 2025 8:53 pm.

A handful of states still offer moving deductions to the general public, including massachusetts and california.